Last week I was having virtual coffee with one of my close friends. We were discussing the housing market and why some buyers are being tentative about actively searching. When I asked her why she had paused her search, her answer wasn’t what I expected: she didn’t want her entire savings to go towards a down payment! As a single mom, the potential of being in new home with no savings was too great a risk.

The truth is, deciding how much you should put down on a home is not the easiest thing to do. There are many variables that you need to account for to make the best decision for your specific needs. Although lenders are more likely to give you a better interest rate when you put down 20% compared to 5%, there are a still a few questions to ask yourself when deciding your down payment amount.

What size monthly mortgage payment can you support?

It is easy to see that you will be required to pay less each month by lowering the total loan amount and paying less interest. If you don’t have enough each month to support a higher mortgage payment, then putting more of your savings down is a good idea. This is especially true if putting more down is going to save you from mortgage insurance.

How much will you have left after making the down payment?

If you’re like my friend, you don’t want to use all your saved money on the down payment, get settled into your home, and then have an emergency happen that you can’t afford to pay for because all your money is tied up in the house.

By putting less money toward your down payment, you will be able to keep more in your savings account. This means that if anything were to happen to your income stream, you wouldn’t be as at-risk of defaulting on your home loan. You will, however, have to pay mortgage insurance until you reach the 20% equity mark.

How long are you planning to live in the home?

The longer you plan on staying in the home, the more valuable each dollar of down payment becomes. If you are staying for more than 10 years, then making a larger down payment reduces the amount of money you pay interest on and you effectively reduce the amount you will ultimately pay for the home (example below).

Are you ok with potentially missing out on a home due to the down payment size?

When faced with the decision between two offers on their home, where the only difference is the amount of the down payment, a seller is much more likely to choose the offer with the higher down payment. This is because the buyer putting down more looks more credible in the seller’s eyes and is less likely to have problems throughout the loan process. This is even more true when looking to purchase a home in a competitive market at a competitive price point.

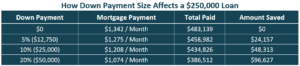

The following example shows how putting different amounts down can lower your overall payment for your home. In the example below, I used a 30-year fixed-rate loan of 5% on a $250,000 loan. Over the life of that loan, if you paid your mortgage on time and put nothing else toward the loan’s principal, you would end up paying $483,139.

Need help navigating through all the things? Call or message me and let’s talk through all the options available to you.

-Arynne

PS- If you’re serious about buying or selling a home this year , let’s connect. ![]() Click here to book a real estate possibility call and let’s develop a winning strategy for you!

Click here to book a real estate possibility call and let’s develop a winning strategy for you!