I’ll be honest, I checked the calendar to make sure it wasn’t April 1st when I saw last week’s National Mortgage Rates. Did you see them? They surged to 3.63% last week — the highest they’ve been since April 2020. And that was the third consecutive week they increased.

Unfortunately, that upward trend is likely to continue as 2022 goes on. With the Federal Reserve pulling back on its purchases of mortgage-backed securities, recent statements by Federal Reserve Chairman Jerome Powell that they expect to raise rates three times in 2022 (Goldman Sachs predicts four by the end of the year) it’s almost inevitable that mortgage and refinance rates are sure to follow.

You may be thinking, “It’s ok that interest rates are going up because home prices are surely going down this year”. Make no mistake; prices aren’t suddenly going to drop. Although home price growth won’t be as enormous as last year (the national median price jumped 19.2% between July 2020 and July 2021), Fannie May forecasts home prices will rise 7.4% this year while property data firm CoreLogic predicts about a 6% increase. It appears home prices are still likely to go up in 2022.

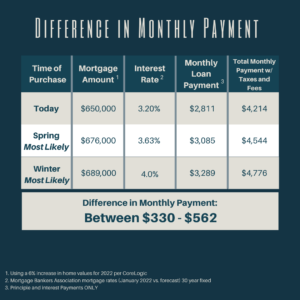

The graphic below demonstrates the difference in monthly payments based on the potential 6% increase in home values (4% by Spring and 6% by Winter) and the forecasted interest rates for 2022. Not only can buying now save you more per month, but it can also save you between $118,800 – $202,320 on the total cost of your mortgage over 30 years.

So, what does this mean for hopeful homebuyers? It means now may be the best time to buy a home or you may need to start preparing to make some sacrifices as the year progresses. With rising rates, you may need to buy a smaller, lower-priced home to get a monthly payment you can afford. You may need to postpone looking so you can save up for a larger sized down payment and a lower mortgage loan amount.

No matter what happens, planning is going to be crucial, so get with an agent, line up a lender, and start mapping out your strategy today. The market moves fast, and you might need to do the same.

Warmly,

Arynne Crane

PS – Want to get started with the home purchase process ASAP? Click here to schedule a FREE real estate possibility call with me!